The Shocking Collapse of Silicon Valley Bank: What Went Wrong in 48 Hours?

The Impact of Silicon Valley Bank’s Collapse on the Banking Industry

How does the 16th largest bank in America collapse? Silicon Valley Bank Failure Explained

Silicon Valley Bank’s collapse is the second-largest bank failure in US history and the largest since the 2008 financial crisis. With $209 billion of assets and $175 billion of deposits, SVB was the 16th largest bank in America. This makes it the biggest bank failure since the collapse of Washington Mutual in 2008 (which had over $300 billion of assets).

How did we get here?

SVB had been operating for over 40 years and had established itself as the go-to bank for startups. It was the preferred banking partner for approximately 50% of all venture-backed startups in the US. This success earned SVB a number of accolades, including being named one of America’s Best Banks in 2022 by Forbes. SVB also received an A rating from Moody’s.

However, as the tech industry boomed over the past decade, SVB became even more closely tied to startups. The bank experienced a huge inflow of deposits from startups, with its deposits tripling between 2018 and 2021.

Investors were giving millions of dollars to startups, and these companies would then deposit their funds with SVB. While this inflow of funds initially seemed like a good thing for SVB, it ultimately led to the bank taking on too much risk.

How does a bank collapse?

In traditional banking, the primary way banks generate profits is by taking deposits from individuals or businesses who have money and then lending that money to others who need it. The interest generated from these loans is how banks generate profits.

Many of SVB’s customers were startups who did not need loans because they were continually receiving investments from investors. As a result, SVB had accumulated a large amount of customer deposits, which it needed to invest in order to generate profits. In an effort to do so, SVB invested in bonds, as it had difficulty making loans to corporate borrowers.

However, this strategy became problematic when interest rates started to rise. SVB had bet that the Federal Reserve would hike rates slowly, but they actually hiked them much faster than anticipated. The Federal Reserve went from zero interest rates to hiking interest rates by over 1,500% in a year. With each interest rate hike, the $80 billion in low-yield bonds that SVB had purchased with customer deposits looked less attractive, as the marketplace was selling similar bonds with a much higher yield. No one wants a portfolio of bonds yielding 1.5% when the marketplace is selling them with a yield above 5%. As a result, SVB began to experience a decline in the value of its bonds, and the deposits it had used to purchase them began to shrink as well.

Furthermore, rising interest rates also had an impact on SVB’s customers. Many of the bank’s clients experienced a slowdown in their business growth, valuations, and funding ability, which led to them depositing fewer funds into the bank and burning through more of their cash reserves. It’s worth noting that when interest rates rise, most banks pay higher interest on deposits to attract more customers.

In addition, Moody’s issued a warning of a possible downgrade to SVB’s credit rating, which could have caused investors and depositors to lose confidence in the bank. To avoid this, SVB decided to sell $21 billion of its bond portfolio at a loss of $1.8 billion to raise money. The bank also planned to raise more money by selling shares, but this announcement created a panic and led to a run on the bank, ultimately contributing to its collapse.

This combination of factors ultimately led to SVB’s collapse.

On Thursday, SVB’s stock plummeted over 60%, prompting many VC funds to advise their portfolio companies to remove their deposits from the bank. The mass withdrawals created a run on the bank, and even Peter Thiel urged his Founders Fund companies to start pulling their money from the bank.

The fear of systemic risk spread throughout Friday, leading to several bank stocks being halted at various points during the day. Nasdaq halted trading of SVB’s stock on Friday after it fell over 60% in premarket trading. Reports emerged that the bank was looking to sell itself, worsening the situation. SVB went from trading over $700 in October 2021 to below $50.

Did someone ask what a bank run is?

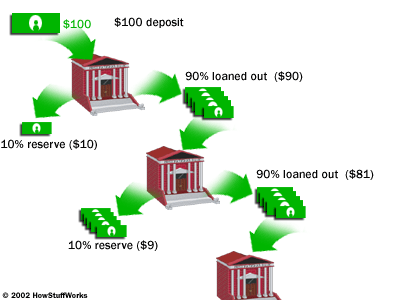

Customers have the flexibility to access their deposits at any time, but banks typically only maintain a small fraction of their funds (at least 10%) and lend out the rest. This practice is known as fractional banking.

However, a bank run can occur when a large number of depositors withdraw their deposits simultaneously, often due to a loss of confidence in the bank’s ability to fulfill its financial obligations. A bank run can create a liquidity crisis because the bank may not have enough cash on hand to meet the withdrawal demands of all its customers. As more and more depositors withdraw their funds, the bank’s reserves diminish further, making it increasingly challenging to meet the withdrawal requests of the remaining depositors.

This can lead to a vicious cycle where more and more depositors rush to withdraw their funds, causing further depletion of the bank’s reserves, and eventually resulting in the bank’s failure.

Fractional Reserve Banking

Fractional reserve banking is a system where banks keep only a small portion of their customers’ deposits in reserve and use the rest to make loans and investments. This allows banks to earn interest on their loans and investments and provide funding to borrowers. However, it also creates the risk of a bank run if too many depositors request their funds simultaneously, as the bank may not have enough reserves to cover all the withdrawals. Here is an example:

Can this happen to your bank?

Less than 3% of SVB’s $175 billion in deposits are insured by the FDIC’s protection, which offers insurance for deposits up to $250,000. This means that over 97% of SVB’s clients have deposits exceeding the limit of $250,000 and are therefore uninsured. In such cases, holders of the uninsured portion receive a “receivership certificate,” which essentially serves as an IOU for any funds recovered.

To ensure optimal protection of your funds, it’s advisable to keep no more cash than the FDIC-insured amount of $250,000 with a single bank and consider using one of the larger, well-established financial institutions.

The FDIC and SIPC are independent agencies that provide protection to consumers in the event of a bank or brokerage firm failure.

The FDIC provides deposit insurance up to $250,000 per depositor, per insured bank, for each account ownership category. In case of a bank failure, the FDIC will provide insurance coverage for the amount of money in the account, up to the limit of $250,000. Only deposits held in participating banks are covered by FDIC insurance. So, it’s crucial to ensure that your bank is FDIC-insured before making any deposits.

The SIPC offers protection to investors against the loss of cash and securities held by a brokerage firm in the event of its failure. The coverage limit for SIPC protection is $500,000 per customer, which includes up to $250,000 in cash held in a brokerage account.

Also worth mentioning

Prior to the collapse of Silicon Valley Bank, some of its top executives sold millions of dollars worth of their shares in the company.

- Gregory Becker, the CEO, sold 11%

- Daniel Beck, CFO, sold 32%

- Michelle Draper, CMO, sold 28%

- Michael Zucker, General Counsel, sold 19%

Silicon Valley Bank also paid out annual bonuses just hours before its collapse and subsequent government takeover.

Garry Tan, President & CEO of Startup Incubator YCombinator said “This is an extinction-level event for startups and will set startups and innovation back by 10 years or more.”

Popular companies with deposits in Silicon Valley Bank:

- $3.3 billion Circle

- $670 million Bill.com

- $487 million Roku

- $227 million BlockFi

- $150 million Roblox

The latest

On Sunday afternoon, Signature Bank was also shut down due to systemic risk. 94% of deposits with Signature Bank are not FDIC insured. Regulators warned that keeping the bank open would threaten the stability of the entire financial system.

On Sunday evening, the U.S. Government announced that all Silicon Valley Bank customers would be protected and granted access to their deposits on Monday. The bailout funds are coming from a special fund established after the 2008 financial crisis. The fund is currently worth $100 billion and is funded by fees charged to banks.

If you enjoyed reading this, please share it with friends & family:

Leave a Reply